Covid-19: The current generation will remember but the future generations will also get several chances to listen to tales of the novel coronavirus. Salary cuts, job losses, high scale lay-offs, high business losses, small business bankruptcy, worst days of the aviation sector, and a lot more, coronavirus had brought all these breathtaking transitions. The semi-final result of these transitions will be clearly visible on the economy of a country.

World in the deepest recession since World War II – Covid-19

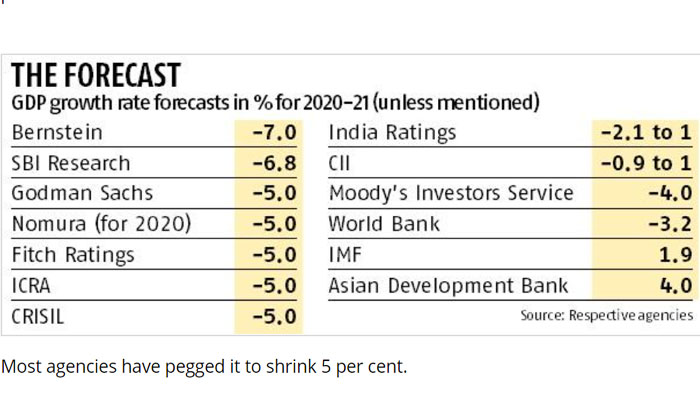

According to the world bank in its Global Economic Prospects (GEP) June 2020, the Indian economy is expected to contract by 3.2% in this fiscal year as a result of the COVID-19 pandemic and its associated restrictions. There is also a 3.1% forecasted growth for next year.

With a forecasted contraction of 5.2% in the year 2020. The world economy, as a whole, is set to witness its deepest recession since World War 2. According to the World Bank Group (WBG) President David Malpass last week, this forecasted contraction can push around 60 million people into extreme poverty.

However, this number could be 70-100 million according to the updated data available on Monday. As a result of the pandemic disruption in domestic supply and demand, finance and trade, Emerging Economic Activities in Advance Economies are predicted to contract by 7%, while Market and Developing Economies (EMDEs) are expected to contract by 2.5% this year. World Bank economist Ceyla Pazarbasioglu said, “This is a deeply sobering outlook, with the crisis likely to leave long-lasting scars and pose major global challenges”.

Countries most reliant on tourism, external financing, global trade and commodity exports are st to be hit the hardest as these businesses are worst affected by the pandemic. Ceyla Pazarbasioglu also said “Our first order of business is to address the global health and economic emergency. Beyond that, the global community must unite to find ways to rebuild as robust a recovery as possible to prevent more people from falling into poverty and unemployment.”

India to grow at -3.2% in FY2020-21

The output is expected to contract by 3.2% (growth becomes -3.2%) in FY2020-21, as the impact of the pandemic will largely fall in this year, despite the fiscal and monetary stimulus.

In FY 2019-20, the growth of India is estimated to have slowed to 4.2 percent. When the outlook for this fiscal was 5.8 percent (positive)-the world was not yet in the pandemic ‘s grasp. For this fiscal year, the growth forecast is 9 percentage points lower than the January 2020 GEP forecasts.

As per the report, spillover effects from weak global growth and balance sheet stress are also weighing down on economic activity. India is forecast to see some recovery next year and grow at 3.1% as of the forecasted recovery

Covid-19 – South a expected to grow at -2.7%

Due to restrictions impacting consumption and services and the uncertainty causing a chill in private investments, for the South Asian region as a whole, economic activity is expected to contract by 2.7% in 2020. The risks to the outlook are heavily skewed to the downside and there is a good chance that the forecasts will be even worse since these forecasts are highly uncertain. The high share of employed workers in the informal sector exacerbates the health and economic challenges caused by the pandemic.

The hike in food prices could also lead to food insecurity for more people and global financial market disruption could add pressure to vulnerable balance sheets. In the South Asian region, spillover effects from major trading partners could have a negative impact on economic activity, and supply chain linkages could depress development in the medium term. It is projected that the region as a whole will expand at a positive pace of 2.8 percent next year.

Read More: IT MINISTER LAUNCHED THE NATIONAL AI PORTAL OF INDIA – AI MISSION FOR INDUSTRIES AND SCHOOLS

Rest of the world

Due to pandemic-caused restrictions and disruptions, the US is expected to contract at a forecasted 6.1% this year. The heavy outbreaks and their impact on the activity on the Euro area resulted in the projected contraction of 9.1 % this year. China is expected to its lowest rate in more than four decades i.e. a contraction of 1% in 2020. Due to the preventive measures that had hit economic activities in Japan, it is expected that it will also shrink at a rate of 6.1% in 2020.