Atmanirbhar Bharat Package: On Wednesday, Finance Minister Nirmala Sitharaman announced some details of the Atmanirbhar Bharat Abhiyan economic package. This is the second tranche of the package including all past actions by RBI as well as the first COVID-19 relief package which was announced during March and April.

Atmanirbhar Bharat Abhiyan Package will cater to various sections including cottage industry, laborers, MSMEs, industries, and others. It is an initiative by the government to promote and support Make in India and local products.

Wednesday’s (13th May 2020) announcements focused primarily on relief for medium, small and micro enterprises (MSMEs).

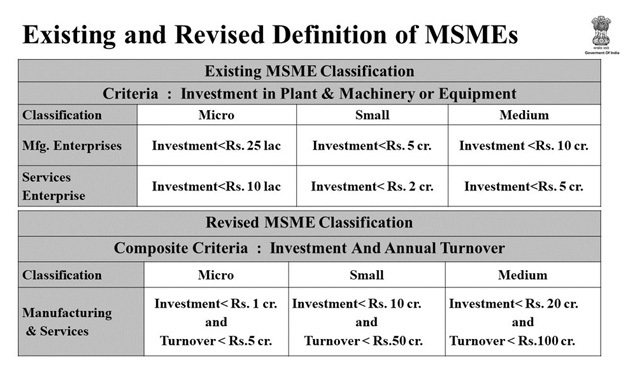

The Centre revised the investment limit for MSMEs and also introduced additional ‘turnover’ criteria for the revised definition.

Nirmala Sitharaman said that the revision was a long pending demand of the MSMEs.

“Low threshold in MSME definition has created a fear among MSMEs of graduating out of the benefits and hence killing the urge to grow,” she said while sharing the details of the Rs 20 lakh crore economic package.

The government has also bridged the gap between the manufacturing and services sectors.

According to the new definition – Atmanirbhar Bharat Package

- – “Micro” Firms are firms with investment up to Rs 1 cr. and turnover under Rs 5 cr.

- – “Small” Firms are firms with investment up to Rs. 10 cr. and turnover under Rs. 50cr.

- – “Medium” Firms are firms with investment up to Rs. 20 cr. and turnover under Rs 100 cr.

- – Here’s the ministry’s table of the existing and revised definition of MSMEs.

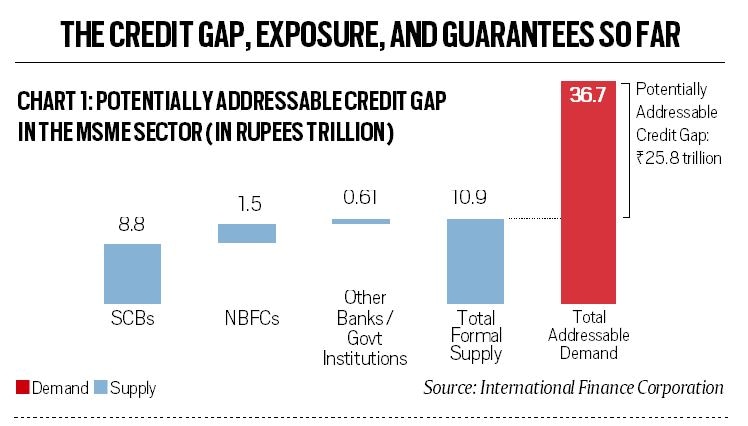

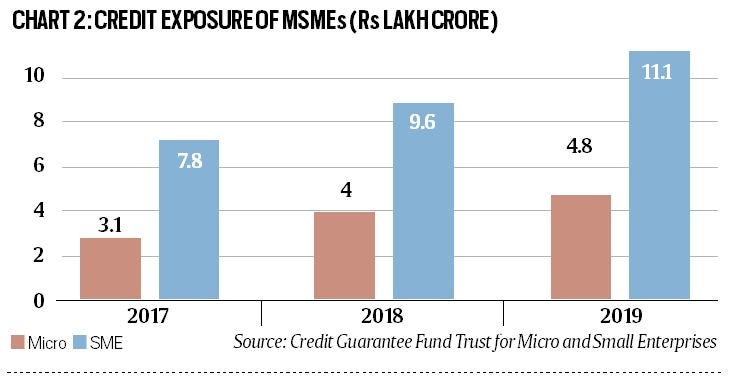

The Centre also announced a massive increase in credit guarantees to MSMEs. However, there was very little actual fiscal outgo that was announced.

In other words, the government has shifted in taking over MSMEs’ credit risks, instead of directly infusing capital into the economy or directly giving it to MSMEs in terms of bailout packages only if they wish to stay in business. These credit guarantees should also aid the formal banking system in meeting the MSME sector’s credit demands.

Credit guarantee- Loans to MSMEs are given against their property as collateral in maximum cases. But in the times of a crisis, like the current COVID-19 pandemic, property prices fall and this hinders MSMEs’ ability to borrow. It also means banks are less likely to lend loans.

A credit guarantee by the government assures the bank that in the event of MSME collapsing, its loan will be repaid by the government. For instance, if the

For example, if the government provides 100% credit guarantee up to Rs 1 crore to a firm, it means that the bank can lend Rs 1 crore to that firm; If the firm fails to pay back, the government will pay back all of Rs 1 crore. If this guarantee was for the first 20% loan, then the government would only give a guarantee to refund Rs 20 lakh.

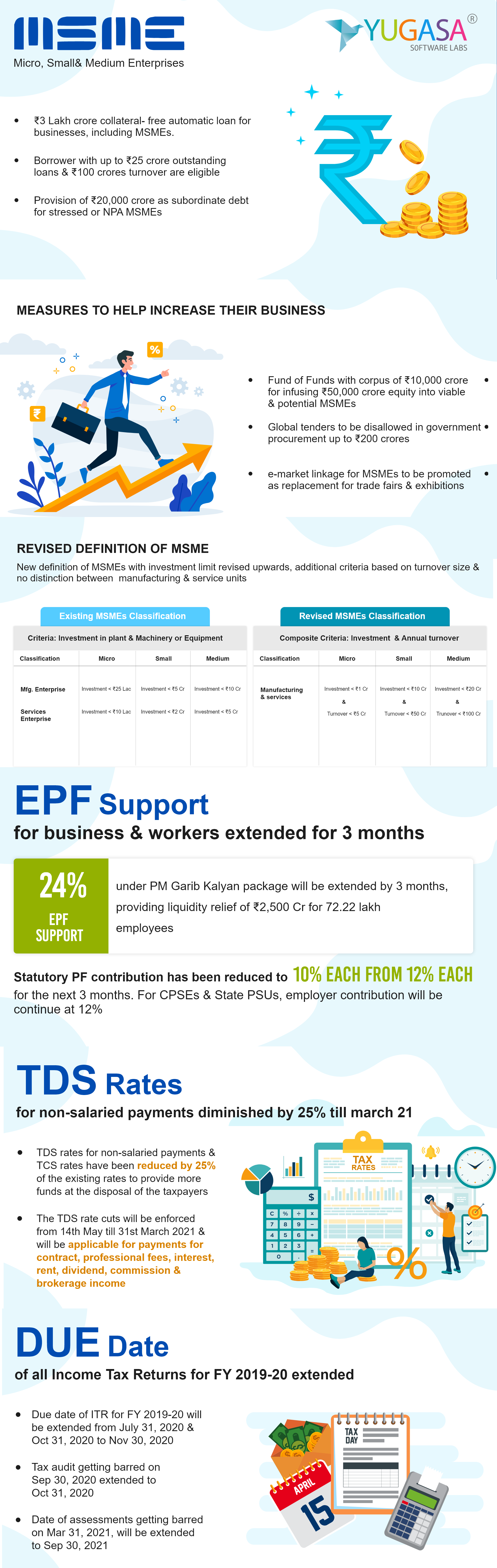

Key Announcements made by Nirmala Sitharaman,

1. Rs 3 lakh crores Collateral-free Automatic Loans for Businesses, and MSMEs –

For those businesses/MSMEs who have been badly hit due to COVID-19 and in need of additional funding to meet operational liabilities built up, buy raw materials, or restart business.

Eligibility- Borrowers with Rs. 25 crores outstanding and Rs. 100 crore turnover

Offer-

- Emergency Credit Line from Banks and NBFCs up to 20% of entire outstanding credit as of 29-2-2020.

- 4 year tenor with 12 months of moratorium on Principal repayment.

- 100% credit guarantee cover to Banks and NBFCs; without any guarantee fee or fresh collateral.

- It can be availed till 31-10-2020.

2. Rs 20,000 crores Subordinate Debt for Stressed MSMEs –

For those stressed MSMEs who need equity support.

Offer- Provision of Rs. 20,000 cr. as subordinate debt; Support of Rs. 4,000 cr. to CGTMSE.

3. Rs 50,000 crores Equity infusion for MSMEs through Fund of Funds –

- For those MSMEs who are facing a severe shortage of Equity.

- Fund of Funds with Corpus of Rs 10,000 cr.

- Provide equity funding for MSMEs with better growth potential and viability.

- The Fund structure will help in leveraging Rs 50,000 cr. of funds at daughter funds level.

4. New Definition of MSMEs

5. No Global tenders will be allowed up to Rs 200 crores – a step towards Self-Reliant India and support Make in India.

6. Other interventions for MSMEs – e-market linkage for MSMEs as a replacement for exhibitions and trade fairs.

· Use of Fintech to enhance transaction-based lending using data generated by the e-marketplace.

· MSME receivables from Gov and CPSEs to be released in 45 days.

7. Rs. 2500 crore EPF Support for Business & Workers for 3 more months –

payment of 12% of employer and 12% employee contributions will be made into EPF accounts of eligible establishments under PMGKP for another 3 months(June, July, and August 2020).

8. Reduced EPF contribution for Business & Workers for 3 months–

Rs 6750 crores Liquidity Support; Statutory PF contribution of both employer and employee reduced to 10% each from the existing 12% for all establishments who are not eligible for support under PMGKP for the next 3 months.

9. Rs 30,000 crore Special Liquidity Scheme for NBFCs/HFCs/MFIs –

Investments will be made in both primary and secondary market transactions, supplement RBI/GoI measures to augment liquidity.

10. Partial Credit Guarantee Scheme 2.0 of Rs 45,000 crore for NBFCs

· The existing PCGS scheme should be extended to borrowing such as primary issuance of bonds / CPs (the liability side of the balance sheet) of such entities.

· First 20% of loss will be borne by GoI (Guarantor)

11. Rs. 90,000 cr. Liquidity Injection for DISCOMs –

DISCOM payables to Power Generation and Transmission Companies is currently ~Rs 94,000 cr.

· PFC/REC will infuse liquidity of Rs 90,000 cr. to DISCOMs against receivables.

· Central Public Sector Generation Companies shall give rebate to Discoms and be passed on to the final industries.

12. Relief to Contractors – Extension of up to 6 months to be provided by all Central Agencies

13. Extension of Registration and Completion Date of Real Estate Projects under RERA – States/UTs should treat COVID-19 as an event of ‘Force Majeure’ under RERA.

Registration and Completion Date to be extended by 6 months for registered projects expiring on or after 25-03-2020.

14. Rs 50,000 crores liquidity through TDS/TCS rate reduction – 25% reduced rates of TDS for non-salaried specific payments made to residents and TCS for specified receipts.

15. Other Direct Tax Measures

- All pending refunds to charitable trusts and non-corporate businesses & professions including proprietorship, partnership, LLP, and Co-operatives shall be issued immediately.

- Due date of all income-tax return for FY 2019-20 extended from 31-july-2020 & 31-oct-2020 to 30-nov-2020.

- Extension of Tax audit from 30-sept-2020 to 31-oct-2020

16. Other Direct Tax Measures

· Date of assessments getting barred on 30-Sept-2020 extended to 31-dec-2020; for those getting barred on 31-mar-2021, will be extended to 30-sept-2021.

· Vivad se Vishwas Scheme for making payment without additional amount will be extended to 31-dec-2020.

Apart from these announcements, GoI has,

- Approved funds for the welfare of Farmers, Fishermens & rural economy, urban, and poor immigrants.

- Provided reliefs under MUDRA-Shishu Loans (interest subvention of 2% for a period of 12 months)

- Set measures for street vendors & middle-income group (Rs 5,000 cr special credit facility for supporting nearly 50 lakh street vendors and credit-linked subsidy scheme for middle-income group extended up to March 2021)

- Sanctioned free food grain supply to migrants for 2 months and Rental Accommodation for Urban Poor as part of PM’s Awas Yojana.