Digital Transformation in Banking: In banking, digital transformation is more than just a change; it goes well beyond simply transitioning from a traditional to a digital world.

The entire concept of digital transformation strategy in banking is an important part of how banks and financial institutions assess, communicate with, and satisfy their consumers.

Understanding client behavior, interests, and needs are the foundation of the digitalization approach in banking and fintech.

As a result, the banking industry has shifted from focusing on products to focusing on customers.

The global digital banking platform market is predicted to increase at a CAGR of 11.3 percent from USD 8.2 billion in 2021 to USD 13.9 billion in 2026, according to a MarketsandMarkets analysis.

According to the survey, the increased need among banks to provide the greatest client experience and the growing adoption of cloud technology in banking institutions are driving this expansion.

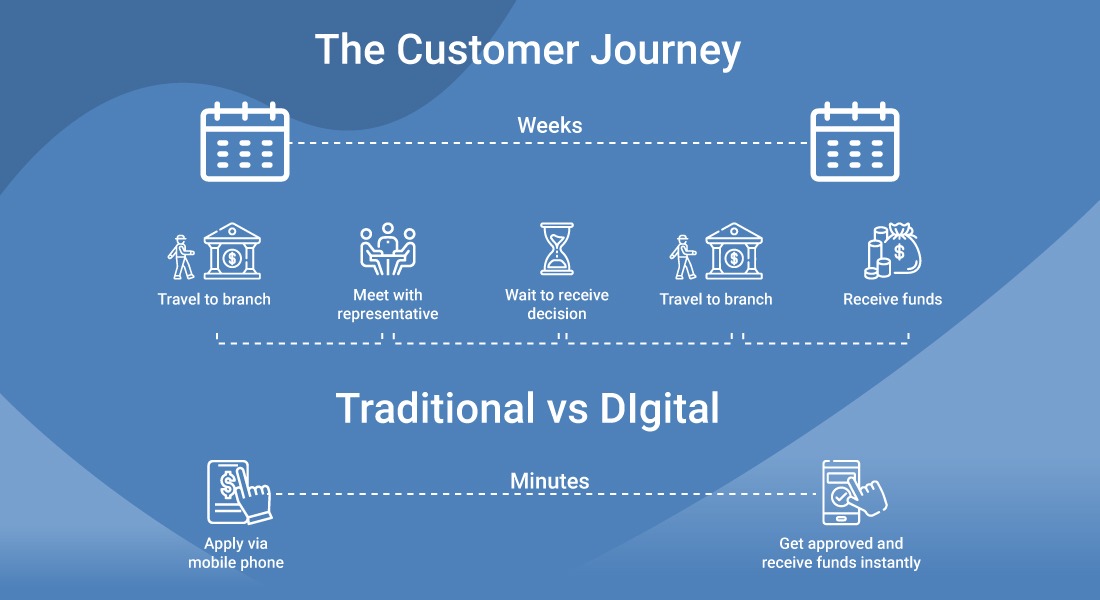

Digital Transformation in Banking: Traditional banking to digital banking transition

Even though there were huge setbacks along the road, most banks started their digital banking journey with a clear strategy years ago.

When financial leaders understood that the majority of their customers use digital channels, the digital banking trend began.

In financial services, omnichannel gained traction as more clients used their mobile apps and websites to do transactions.

As a result, mobile banking has become an essential component of the digital banking journey.

Traditional banks had to adapt to new technology and operating models that could keep them in the loop throughout the whole client journey to keep up with the ever-changing market.

Simultaneously, the expansion and increased demand for Artificial Intelligence (AI), blockchain, and the Internet of Things (IoT) has hastened the banking industry’s modernization process.

Currently, banks rely heavily on an omnichannel strategy, which involves breaking down data silos across all channels to improve the client experience.

This shift to digital banking has aided financial service providers in increasing efficiency, producing growth and convenience, as well as the possibility to attract new consumers.

This leads us to our next topic of discussion: the essential variables that enable digital banking and financial services transformation.

Banks’ digital transformation is being fueled by several different sources

The digital transformation movement, which brings banking solutions to customers’ doorsteps, is being driven by greater use of smart devices, enhanced connectivity, and a demand for a good end-user experience.

Customers are extremely important

Why would a bank make the switch to a digital platform? That’s because that’s where their clients are.

The digital strategy is focused on meeting the requirements and expectations of the company’s customers.

With modern solutions, banks can now provide individualized product experiences, seamless query disintegration, transparency, and security, all of which contribute to client pleasure.

In brief, the change has necessitated the adoption of a “customer approach,” resulting in the highest level of engagement.

Infrastructure modernisation

As previously said, accomplishing digital transformation entails more than merely integrating new technology.

The underlying infrastructure that connects data to the front-end operations has aided the digital revolution of financial services today.

As a result, the most important component in enabling digital transformation in banking has been updating the aging infrastructure.

Data’s Significance

Consumer data has a lot of power, which banking and financial companies are well aware of.

This entails putting in place more data analytics procedures to study and track customer behavior.

This has aided the banking industry in developing more relevant products and services that are in line with client requirements.

Modern banks rely on digital technologies – Digital Transformation in Banking

When the concept of digital transformation in financial services was first introduced, banks began by devising a detailed strategy to restructure their business models, improve client offerings, and establish a seamless customer-centric process.

The banking sector embraced digital transformation technology to generate value for both banks and their clients for this process to succeed.

The digital banking industry employs a variety of tools and technologies, which are listed below.

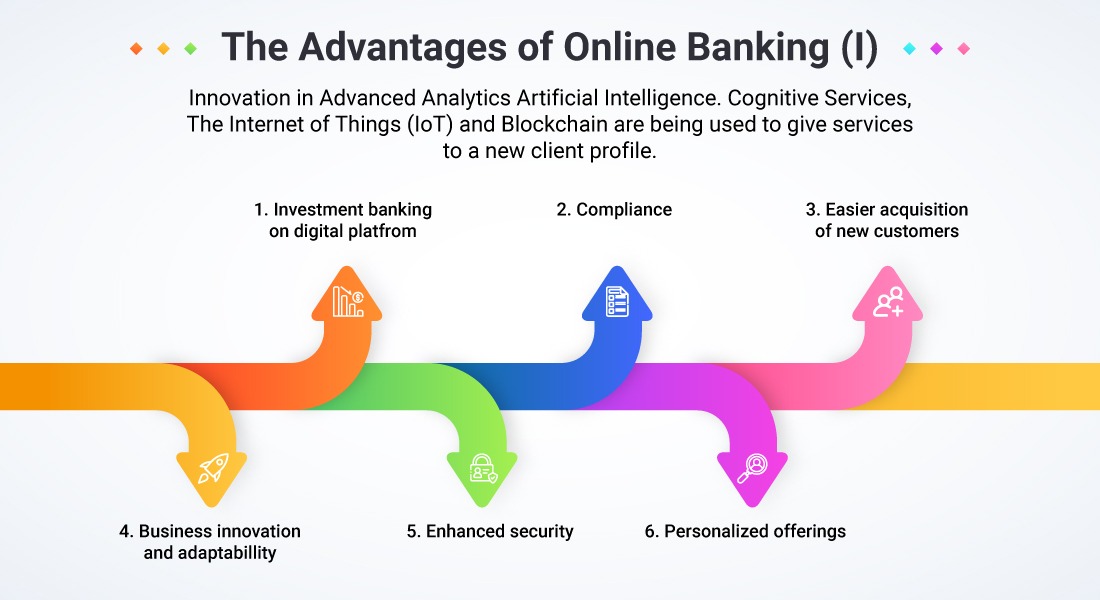

The advantages of digital banking transition and what it means for businesses

As previously said, digital banking is much more than just instant transactions and internet banking.

For small and medium-sized businesses, large organizations, and comparable institutions, banking digitization opens up a slew of new possibilities.

The following advantages have resulted from digital banking innovation.

Digital platform for investment banking

Reduced intermediate processes, data transparency, and other methods to access intellectual data have all emerged from the growth of digital banking.

All of these elements have a positive impact on operating costs while also making transactions easier and faster.

Small investors brought together on a consolidated digital platform have replaced investment banks as a result of banking digitization.

The digital revolution has also caused investment banks to focus on short-term objectives and allow urgent client needs to dictate their technology expenditures, which is wonderful news for digital companies and businesses.

Compliance

Banks have found it easier to keep compliant by switching to a new digital financial management system.

Employees can spend less time auditing reports and documents thanks to advanced capabilities like auto auditing.

The digital data remains standardized and can be exchanged without error across many systems.

Furthermore, the cloud-based digital payroll system provides timely updates, removing the need for banks to keep up with changing legislation.

Getting new consumers is a lot easier now

Customers are required by businesses, just as services are required by customers.

Because financial organizations are no longer passive about their offerings, attracting new clients has grown cheaper and easier for many sectors, not just banks.

Every client and business can run smoothly with rapid online payment.

Business flexibility and innovation

The rise of social media platforms, shopping websites, and mobile banking apps has made it easier for banks and other businesses to communicate with their clients.

This financial digitization has spawned a slew of new business ventures that rely heavily on banking services.

Lastly

In the digital transformation in banking businesses, Yugasa can be a dependable technology partner.

Yugasa has the greatest expertise to help its clients with everything from UX strategy to the integration of contemporary data solutions.

For customized digital transformation services for your financial organization, contact us.

Read More: DIGITAL TRANSFORMATION IN EDTECH SECTOR – BENEFITS, DRAWBACK, AND STRATEGY IMPLEMENTATION